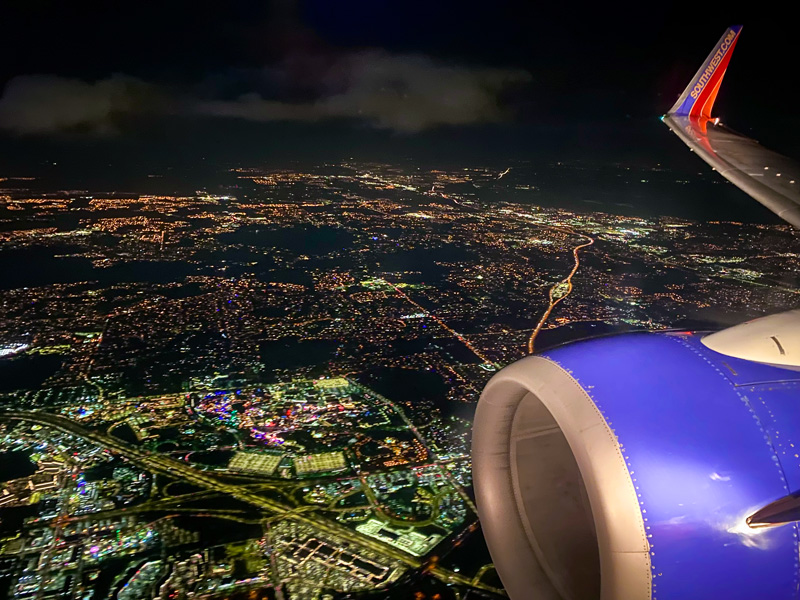

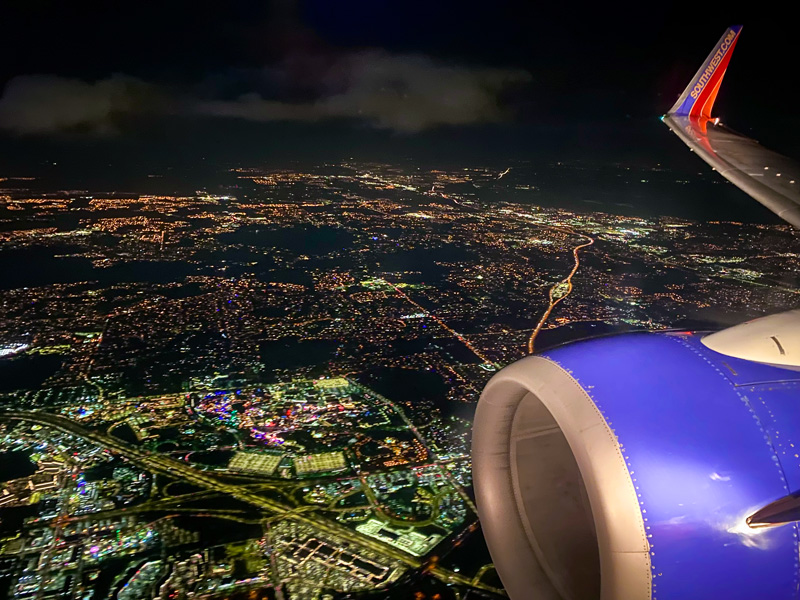

Umbrella Bob strikes back! In a move that can best be described as “Chapekian,” the Walt Disney World fan-favorite airline is changing everything that made Southwest, Southwest. This article details the huge changes to the budget carrier that will fundamentally alter allegiances with family travelers for decades to come.

To be clear, the title is sarcasm. Questioning whether Bob Chapek had suddenly been promoted to CEO of Southwest Airlines is what first crossed my mind when hearing this news. I also may or may not have looked up SWA’s Board of Directors to see if ole Bobby Boy had snuck into a high-level leadership position. Chapek is unaffiliated with Southwest Airlines…for now. Perhaps he’s waiting for a call from Spirit. That does seem more his speed.

As it turns out, Southwest Airline’s CEO is Bob Jordan, who also serves as President and Vice Chairman of the Board of Directors. Bob is a 36-year Southwest veteran, who has held 15 different positions in the company. Bob Jordan, as with Bob Chapek before him, proves that decades-long veterans of a company can somehow manage to misunderstand the foundation of fandoms and brand loyalty. At minimum, both demonstrate a lack of concern about alienating the people who make up the respective companies’ core customers and risking what leaders before them built-up over decades. Must be a “Bob Thing.”

Here’s a rundown of the changes according to Southwest Airlines, which obviously is trying to spin these in the best light possible:

- Southwest will continue to offer two free checked bags to Rapid Rewards A-List Preferred Members and customers traveling on Business Select fares, and one free checked bag to A-List Members and other select customers. Southwest will credit one checked bag for Rapid Rewards Credit Cardmembers.

- Southwest customers who do not qualify for these free bag options will be charged for their first and second checked bags, with weight and size limitations applying. (Emphasis added.) Changes will apply to flights booked on or after May 28, 2025.

- The carrier recently adjusted the number of Rapid Rewards points customers earn on qualifying flights. Customers now earn more points on Business Select fares while earning less on Wanna Get Away and Wanna Get Away Plus fares. (Emphasis added.)

- Southwest Rapid Rewards, the carrier’s loyalty program, will also introduce variable redemption rates across higher-demand and lower-demand flights.

- These strategic moves, aimed to deepen and reward loyalty between Southwest and its most engaged customers, create new opportunities to reach consumers who value fare above everything else. To align with these changes, Southwest will introduce a new, Basic fare on our lowest priced tickets purchased on or after May 28, 2025, in advance of offering assigned seating and extra legroom options.

- Southwest continues to widen its distribution channels to reach new customers, with flights and fare products now available to book through online travel agency Expedia, beginning last month.

- Flight credits issued for tickets purchased on or after May 28, 2025 will expire one year or earlier from the date of ticketing, depending on the fare type purchased.

In a nutshell, Southwest is ending its “bags fly free” program and charging all but business travelers and high-status customers for checked bags. Southwest is also reducing the points most customers earn on flights on the one hand, and devaluing its points upon redemption on the other hand.

Southwest is also introducing a basic economy fare that could, in theory, be cheaper than its current fares. Equally likely, it will result in nickel & diming a la Frontier and Spirit that hits consumers with hidden fees and upcharges after the lower upfront booking. These changes come ahead of the rollout of assigned seating and premium legroom categories, which were previously announced.

Southwest Airline’s changes come after months of pressure from activist investor Elliott Management. The firm took a stake in the airline last year and won five board seats as it pushed for major changes at the company, which clung to perks like free checked bags, no change fees, and open seating.

“Two bags fly free” is a registered trademark of Southwest Airlines. Its about-face on what executives long cast as a sacrosanct passenger perk comes as something of a surprise. United’s CEO likened Southwest ending its flyer-friendly baggage policies to the “slaying of a sacred cow.”

At the same time, it’s not surprising that investors would want a slice of that “fee pie.” Other airlines generated more than $5 billion from bag fees last year, according to federal data.

Southwest executives have long said they would not charge for bags, telling Wall Street it’s a major reason why customers chose the airline. (Like Costco and cheap hot dogs!) Just last fall, Southwest doubled-down on this position at its investor day, stating it had down rigorous research that such a policy would cost the company $300 million.

Although Southwest said that it would gain between $1 billion and $1.5 billion from charging for bags, the company indicated it would lose $1.8 billion of market share over time. Southwest said at the time that its ‘bags fly free’ policy generates market share gains in excess of potential lost revenue from baggage fees.

In “fairness,” Southwest’s stock was up 8% on the day (an otherwise down one for the broader markets) after announcing these changes. That suggests Wall Street strongly endorses the moves as being good for business. Of course, it’s fair to point out that what’s good for investors in the short term is often at odds with what’s good for companies in the long term.

This is especially true for companies that have spent decades building up fan loyalty and brand goodwill. We’ve had an article or two ’round these parts about the dangers of chasing quarterly results at the expense of inflicting reputational damage. (I’m not a fan of this approach, to put it mildly.)

Turning to commentary, the title wasn’t a joke. Well, it was to the extent that I didn’t actually believe Bob Chapek had secretly become CEO of Southwest Airlines. But I’m completely sincere that this strikes me as a very Chapekian move, analogous to what happened to Walt Disney World a few years ago. Bob Chapek is not running Southwest, but it’s the same type of short-term gains mentality that’s ruining Southwest.

In both cases, those calling the shots seem to fundamentally misunderstand the appeal of their products. In Southwest’s case, the company has revealed a dramatic turnaround plan, that (spoiler alert) mostly copies the business plans of legacy carriers like Delta, United, and American.

During presentation to investors late last year, Southwest Airlines executives laid out plans for assigned seating, extra-legroom seats for purchase, a redesigned cabin, and other behind-the-scenes initiatives designed to increase revenue and turn around an underperforming stock price.

Fast-forward to today, and Southwest is ditching its unique playbook of more than 50 years that had developed it a loyal fan following in favor of an airline that largely resembles most of its peers. Now, Southwest is dropping its famous “bags fly free” slogan as part of a massive push for the carrier to end long-standing customer perks and policies. Sound familiar?

It’s not that much different than Walt Disney World making a variety of business decisions and justifying them on the basis of what’s “standard industry practice.” Both companies have seemingly forgotten what makes them standouts in their respective travel classes, voluntarily ditching their distinct advantages to be more like everyone else. Unicorns who’d rather be among a herd of horses.

We’ve often pointed out that despite Walt Disney World being a resort business that also operates theme parks, Disney actually is not that good of a hotelier. We’ve further argued that it made little sense for Disney to chase Marriott, Hilton, and Hyatt–that Disney is better off differentiating itself and competing on its own terms (themed design, perks, etc.)–that Disney cannot compete on the terms of real world hotel brands.

This is because even most mid-tier chained-brand hotels handily beat Disney on operations. When it comes to the luxury properties (JW Marriott, Park Hyatt, Conrad, etc), there’s absolutely no competition. All of those brands handily trounce even the best Deluxe Resorts. Hence Disney being better off competing on its own terms and differentiating its product offerings to minimize comparisons, as opposed to inviting them.

It’s the same story with Southwest versus the legacy carriers. The competitive advantage that Southwest had was its loyalty among its fans and families as being the convenient and friendly airline that offered perks and less friction. Southwest has built generational goodwill on the basis of its intangibles.

Even though it was technically a budget airline, Southwest has, over time, inched up into the pricing territory occupied by Delta, United, and AA. Despite that, it was still preferred by some travelers because it offered a distinct advantage via attitude, perks, and a traveler-friendly ethos.

In voluntarily giving that up for some reason, Southwest is going to invite freer comparison–and comparison shopping on price–via consumers. Travelers will try Delta, United, and American as a result.

That should be worrying for Southwest because, frankly, it cannot compete with those airlines on the overall experience. Those airlines offer premium cabins, lounges, international destinations & alliances, reward partners, and–most importantly–have invested significantly in their terminal and in-flight experiences in recent years. Southwest has none of that.

I have some degree of sympathy towards Bob (Jordan, not Chapek). He and other Southwest executives have fought a hard fight against activist investors, even as the airline has endured struggles. They tried to retain the ‘secret sauce’ that made Southwest, Southwest, but ultimately had to give in.

Part of this is happening no doubt because Wall Street is seeing the success that other domestic airlines are having in catering upmarket towards business and luxury travelers. That’s been a growth engine for Delta and United, and those legacy carriers have increased their premium product offerings to improve their businesses. Investors are salivating at that, and want the same for Southwest.

Not to stereotype or paint with too broad of a brush, but I would hazard a guess most Wall Street types have never flown Southwest. They don’t seem to grasp what it is–or rather, what it is not. Bluntly, Southwest is not an airline catering to business or luxury travelers. They are upending their business to chase a market that does not exist.

In the process, once families and leisure travelers who were loyal to Southwest have tasted the proverbial steak (and not even filet, since the U.S. legacy carriers aren’t that good compared to their international counterparts) of Delta or United, they aren’t going back to the hamburger helper that is SWA. I say this as someone who used to fly Southwest exclusively and still does from time-to-time. Every time I fly SWA, I remember why Delta is my favorite airline.

In terms of the Disney trip planning angle, that’s it. Don’t be a creature of habit and continue to fly Southwest if there’s no compelling reason for you to remain loyal. Vote with your wallet and feet, and jump to a different carrier. The ‘best’ airline for you will vary based on your home airport, but consider giving others a shot. For us, flying between Southern California and Orlando–or LAX to international destinations–Delta is far and away the best U.S. carrier. It’s not even a remotely close call.

Your mileage may vary, quite literally in this case.

The timing of this move by Southwest also strikes me as really odd. To Bob Chapek’s credit (words I hate typing), at least his approach to degrading the Walt Disney World guest experience was well-timed. It was done during a tumultuous time that offered Disney the cloak of the phased reopening as an excuse to reset the guest experience–and consumer expectations.

It’s obvious to us that was a convenient excuse, but more importantly, it was opportune timing. Disney under Chapek acted aggressively once it realized revenge travel was going to be a thing, and capitalized on pent-up demand and reduced consumer expectations to raise prices while cutting corners and removing perks. People kept packing the parks, regardless, because they were making up for lost time and traveling again.

Once it became clear that pent-up demand was running its course (some other things also happened), Disney seized the opportunity for another reset. It axed Chapek and brought back the Beloved Bob (Iger) to make popular decisions and be the fan savior for a bit, before becoming the villian. That’s the CliffNotes version, but the point is that Walt Disney World’s trajectory has been to improve the guest experience, fix things, and pull various “levers” to win over former fans and consumers–and that’s an arc that began over 2 years ago!

Southwest seems to have missed the memo that pent-up demand is over, and is speedrunning Walt Disney World’s misguided decisions from ~4 years ago. At least back then, the decisions–however misguided–could be leveraged for a short-term bump before a “hero” came back to restore the company to its former glory.

Instead, Southwest Airlines is doing this at a time when consumer confidence is cratering, markets are down, and a recession is looming. They’re also making these moves in a fundamentally different position from Walt Disney World, which still had a compelling product and unparalleled position as the market leader. The circumstances here are completely different, making this move all the more confounding. It’s a bold move, Bob, let’s see if it pays off for ’em!

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of these changes at Southwest Airlines? Do these strike you as Chapekian short-term gains at the expense of long-term gains? Are you a fan of SWA or do you prefer other low cost or legacy carriers? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!